Blog Post

Why China’s haste to internationalise the renminbi?

This blog raises two questions. The first is puzzling: why is Beijing in such a hurry to internationalise its inconvertible currency? The second is bigger: can the RMB acquire the status of an international currency?

Last week, the People’s Bank of China (PBC), the Chinese central bank, signed agreements with the Bundesbank and Bank of England, respectively, over the clearing and settlement of renminbi (RMB) payments in Frankfurt and London, marking an expansion of RMB payment facilities into the Europe trading zone. These moves come in the wake of similar PBC agreements with the monetary authorities in Hong Kong, Singapore and Taipei over the past few years. In this context, this blog raises two questions. The first is puzzling: why is Beijing in such a hurry to internationalise its inconvertible currency? The second is bigger: can the RMB acquire the status of an international currency?

The latest PBC agreements with Frankfurt and London signal that the external use of the RMB is gaining global momentum, expanding well beyond Hong Kong where a little noticed offshore RMB market first started a decade ago in 2004 when local residents were allowed to convert their Hong Kong dollars into RMB subject to a daily limit of twenty thousand RMB. This tiny offshore RMB market remained obscure and boring for five sleepy years until the global financial crisis. Then Beijing policymakers in 2009 suddenly got serious about promoting the wider international use of the Chinese currency.

A host of policy measures have since been put in place to expand the offshore RMB markets, initially in Hong Kong and now across major global and regional financial centres. First, the Chinese government in 2009 unveiled a pilot scheme of RMB settlement in cross-border trade and issued the first ever RMB-denominated treasury bonds in Hong Kong, aiming to establish an offshore benchmark RMB yield curve. Then, in 2010, all banks and corporations in Hong Kong were allowed to open RMB accounts and conduct RMB business. In addition, some central banks and commercial banks participating in RMB trade settlement and clearance were invited to participate in the onshore interbank bond market in China. In 2011, the first RMB-denominated corporate bond was issued in Hong Kong, and an experiment was launched to allow RMB-denominated outward and inward direct investment from and into China and to allow offshore RMB funds to be invested in onshore debt and stock markets under a quota. By 2012, any non-resident could open an RMB account and trade RMB products in Hong Kong. Over the past five years, the PBC has signed bilateral local currency swap agreements with more than twenty central banks, including the ECB and Bank of England, to provide backstops for RMB liquidity in case needed.

The Chinese government has been following a three-pronged approach to promoting the external use of the RMB. The first move was to encourage cross-border trade settlement in the RMB, even while China’s capital account was still heavily managed. This has facilitated cross-border RMB outflows from China to build up the initial offshore RMB liquidity pool in Hong Kong. The second has been selective and incremental capital account opening. The two-way cross-border financial RMB flows now also take place through the direct investment channel and via managed schemes of portfolio investment and bank loans. The third step has been the creation of offshore RMB markets where RMB products trade freely among non-residents. Once offshore, the RMB is now fully convertible, with most RMB products being traded freely. However, cross-border RMB flows are still managed.

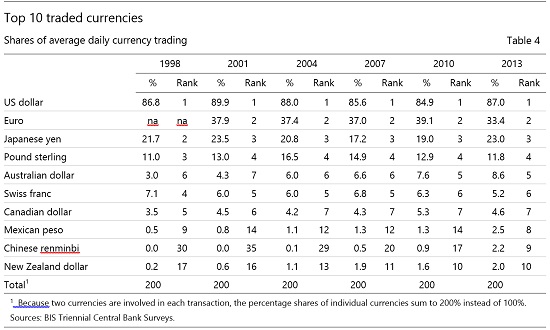

The offshore RMB market has been moving along impressively after embarking on the active internationalisation path in only five years (Graph 1). Cross-border RMB trade settlement has expanded from nil before 2009 to a current level of some 15% of China’s total exports and imports. RMB deposits rose tenfold between 2008 and 2013 in Hong Kong, exceeding 10% of Hong Kong’s total bank deposits, although still below 1% of China’s total domestic bank deposits. RMB-denominated bonds outstanding in Hong Kong have also risen ten times to RMB350 billion (US$55bn). There is a wider range of RMB products now available offshore, including spot, FX derivatives, interest rate derivatives, certificates of deposit, loans, bonds and equity-linked products. The RMB was the ninth most traded currency in 2013, up from 29th in 2004, according to the BIS Triennial Central Bank Surveys (Table 4). Geographically, offshore RMB markets have spread from Hong Kong to Taipei, Singapore, London and now Paris and Frankfurt. Some 20 central banks have reportedly invested part of their reserves in China’s onshore interbank bond market, and more have gained RMB exposure via Hong Kong.

So a puzzling question begs why there has been such haste since 2009 for Beijing policymakers to promote the international use of the Chinese currency that at least then was still far from convertible, heavily managed and according to some, misaligned or outright undervalued. Even today, the RMB arguably remains so to some extent. This is not to mention that China’s domestic financial market still has a long way to go to match its international peers (McCauley (2011)). Is the RMB internationalisation a bit precocious? Some media commentators also speculated about Beijing’s intention to seize the moment of crisis to challenge the US dollar as a dominant reserve currency. On the other hand, some Chinese academic sceptics have expressed reservations about a strategy to rush the RMB internationalisation, arguing that this is risky and no more than a stealth two-track capital account opening that permits cross-border arbitrage between onshore and offshore RMB exchange rates and interest rates.

On the other hand, one can argue that Beijing could leverage its strength on other fronts to facilitate the external use of the RMB. Globally, China is the top trader, the second largest economy and second biggest international net creditor, with a strong record of economic growth and inflation. Also, some existing impediments are neither insurmountable nor as serious as often assumed. For example, a fully internationalised currency does eventually require capital account convertibility. Yet the offshore RMB market could still expand meaningfully for some time, while the Chinese capital account remains regulated. Moreover, the PBC is currently preparing new capital account liberalisation measures. Also, while a heavily managed RMB may not appeal to reserve managers who seek currency diversification, neither does an extremely volatile RMB. The recent policy moves by the PBC to instil some two-sided market volatilities and to widen the daily RMB trading band are steps in the right direction if done in a measured manner. Finally, as to possible exchange rate misalignments, I am not fully convinced that the RMB today remains meaningfully undervalued, as it has appreciated 40% in real effective terms since the 2005 de-pegging and perhaps more than 50% if measured in relative unit labour cost (Ma et al, 2012).

In my view, there are at least three possible and complementary reasons why Chinese policymakers have proactively encouraged the internationalisation of the RMB since the global financial crisis. First, the wider external use of the RMB would allow China to better share currency risk with the rest of the world, mitigating the country’s huge long-dollar and short-RMB position (Cheung et al (2011); and Ma and McCauley (2013)). China’s net long dollar (and euro) exposure could potentially reach 50% of its GDP. A more widely used RMB may help denominate more of China’s external claims and lessen the currency mismatch. Second, a more internationalised RMB may spur further domestic financial liberalisation, a parallel being China’s preparation for WTO accession in 2001, which helped remove many impediments to domestic market liberalisation. This argument has been controversial in China. And third, China may aim to one day have the RMB become one of the important reserve currencies, such as those that make up the SDR, and thus join the group of countries forming the core of the international monetary system. In all, Beijing appears to have no ambition to challenge the current international monetary system and instead wants to become a serious stakeholder.

So, while the puzzling question regarding Beijing’s possible motives would remain debated for some time, the bigger question is whether and how quickly the RMB can achieve the status of an international currency. There are three pivotal factors here. First, China still faces with the challenging task of achieving a deep and liquid domestic financial market and open capital account, in addition to containing the domestic financial imbalances that have built up in recent years. Second, the prospect of a greater global role for the Chinese currency also in part depends on the evolving fundamentals of the incumbent global reserve currencies. Third, potential slots for major international currencies are likely limited. While a global portfolio with additional currencies may yield greater diversification benefits, managing its currency risks could also become more costly, given the externalities of the network effects in the currency market. Presumably, there would be only a small, optimal number of currencies in a typical global portfolio.

***

References:

Cheung, YW, G Ma and R McCauley (2011): “Renminbising China’s Foreign Assets”, Pacific Economic Review, Vol 16, No 1, pp 1-17.

Ma, G and R MCauley (2013): “Global and euro imbalances: China and Germany”, in M Balling and E Gnan (ed), SUERF 50 Years of Money and Finance: Lessons and Challenges, pp 43-72.

Ma, G, R McCauley and L Lam (2012): “Narrowing China’s current account surplus: the roles of saving, investment and the renminbi”, in H McKay and L Song (ed), Rebalancing and Sustaining Growth in China, The Australian National University Press.

McCauley, R (2011): “Renminbi internationalisation and China’s financial development”, BIS Quarterly Review, December, pp 41-56.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.