Blog Post

Naughty students or the wrong school: why is the European Semester proving ineffective?

The fundamental problem of economic policy coordination in the EU is that national policymakers are accountable to their national parliaments and focus on national interests, which in many cases differ widely in different member states. It is therefore not all that surprising that economic policy coordination in the EU hardly works.

The European Semester is an annual EU process which aims to improve economic policy coordination and ensure the implementation of the EU’s economic rules. Each Semester concludes with recommendations for the euro area as a whole and for each EU member state.

1. Are European Semester recommendations implemented?

Not really, as we show in a briefing paper prepared for the European Parliament’s Economic and Monetary Affairs Committee. Similarly to the work of Servaas Deroose and Jörn Griesse, we calculate a reform implementation index, which ranges between zero (no or limited progress on all recommendations) and one (full implementation of, or substantial progress on, all recommendations). The index is based on the qualitative assessment of the European Commission (we note that an alternative assessment may lead to a different result). We find that implementation of recommendations was modest (40 percent in the EU) at the inception of the European Semester in 2011, yet instead of improved implementation in later years as the European Semester matured, the implementation index fell steadily to 29 percent in 2014.

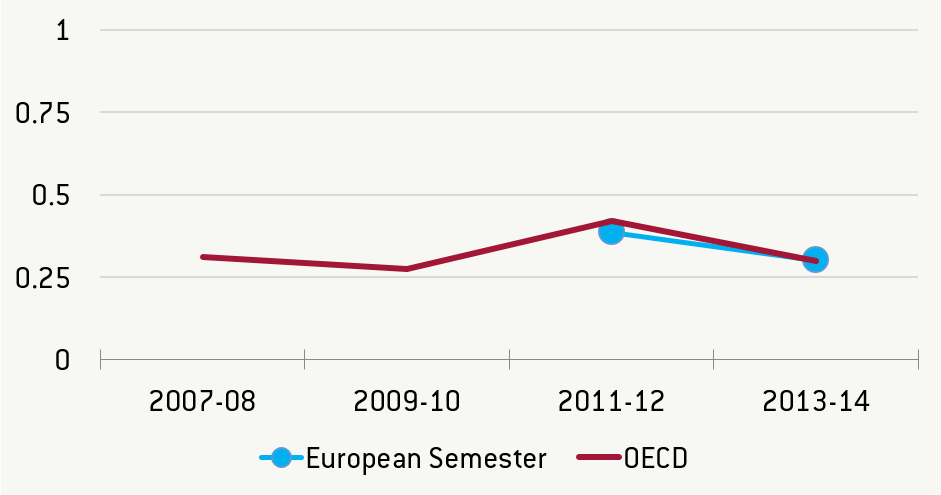

Moreover, the rate of implementation of European Semester recommendations is not higher than the rate of implementation of the OECD’s unilateral recommendations (Figure 1). Overlaps between the European Semester and OECD recommendations only partly explain this similarity. Figure 1 also shows that the OECD reform responsiveness rates were practically the same in 2013-14 and in 2007-08, suggesting that reform efforts have not increased compared to the pre-crisis period.

Figure 1: Reform implementation: comparison of European Semester and OECD Going for Growth recommendations (average of 16 EU countries)

Source: Bruegel using European Commission, European Parliament and OECD data. Note: The European Semester reform implementation index is our calculation: we gave a score of 1 to ‘full/substantial progress’, a score of 0.5 to ‘some progress’ and a score of zero to ‘no/limited progress’: our indicator is the average score. Progress assessments are made by the European Commission. The OECD’s ‘reform responsiveness rates’ are calculated by the OECD for two-year periods; for comparability, we also calculate our European Semester reform implementation index over the same periods. We show the unweighted average for those 16 EU countries for which both European Semester and OECD data is available in the full period. Further details about our indicator and country-specific data are available in our paper.

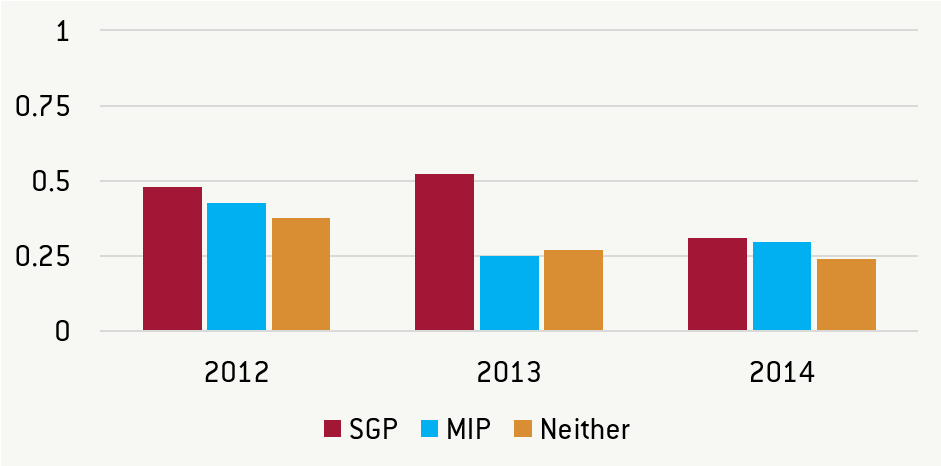

The rate of implementation of recommendations related to the Stability and Growth Pact (SGP) is typically higher (44 percent on average in 2012-14) than the implementation of recommendations related to the Macroeconomic Imbalance Procedure (32 percent in 2012-14) and other recommendations (29 percent in 2012-14); see Figure 2. Even though SGP recommendations have the strongest legal basis, the average 44 percent implementation rate cannot be regarded as large, while the MIP implementation rate is even lower, suggesting that the European Semester is not particularly effective in enforcing the EU’s fiscal and macroeconomic imbalance rules.

Figure 2: European Semester implementation rates according to the type of recommendations (average of 21 EU countries)

Source: Bruegel using European Commission and European Parliament. Note: SGP = Stability and Growth Pack. MIP: Macroeconomic Imbalance Procedure. See the calculation of our index in the note to Figure 1. We show unweighted averages for the recommendations made for those 21 EU countries for which data is available in the full period.

2. Are euro-area recommendations well reflected in country-specific recommendations?

Not really, with the exception of the recommendation on reforming services markets. Even those euro-area recommendations which are perhaps less controversial, such as to reduce the tax wedge on labour, are hardly reflected in country-specific recommendations (CSRs). We highlight that we did not assess the desirability of euro-area recommendations: instead, we have taken euro-area recommendations as given (since it is the right of the Council to set the priorities) and assessed their consistency with CSRs.

One of the euro-area recommendations aims to “Coordinate fiscal policies to ensure that the aggregate euro-area fiscal stance is in line with sustainability risks and cyclical conditions.” We find the reference to the aggregate fiscal stance vague and see two crucial problems. First, nothing is said about how the optimal fiscal stance should be determined. Second, irrespective of the way the optimal fiscal stance is defined, the approach to achieving a desired aggregate fiscal stance is not top-down, whereby the optimal aggregate stance is taken as the starting point and national budgets are determined accordingly. Instead, the resulting aggregate stance is just the sum of national budgets and it is accidental if this sum is equal to what is considered optimal.

We highlighted an inconsistency concerning the aggregate fiscal stance in the text approved by the Council. The preamble of the Council recommendation for the euro area states that “coordination of fiscal policies remains sub-optimal” and the ensuing sentence suggests that there are two reasons for this: (1) countries with high debt might not have carried out sufficient fiscal consolidation to bring down public debt, and (2) countries with more fiscal space might have not seized the opportunity to encourage domestic demand. Yet while countries with high public debts are recommended to consolidate, countries with fiscal space are not recommended to expand.

On the latter issue there is a difference in opinion between the European Commission and the Council: for Germany, the recommendation proposed by the European Commission suggested “using the available fiscal space”, but this suggestion has been deleted by the Council. Certainly, it is the legitimate right of the Council to decide on a tighter fiscal stance than what is proposed by the Commission, but the removal of the reference to the use of the available fiscal space shows that one of the two aspects of sub-optimal fiscal policy coordination does not need to be remedied according to the Council.

We also highlighted that in 2012, 2013 and 2014 the Council made recommendations for more symmetric adjustment within the euro area, but this recommendation has disappeared in 2015. This suggests that the lack of symmetric adjustment within the euro area is no longer considered an important issue.

3. Are there options to significantly improve the effectiveness of the European Semester?

Not really. There are a number of useful ways to improve the functioning of the European Semester, as we review in our paper, in particular by decentralisation efforts to achieve greater involvement of national stakeholders in discussions and decisions on the reform process. However, the fundamental problem of economic policy coordination in the EU will remain: national policymakers are accountable to their national parliaments and focus on national interests, which in many cases differ widely in different member states.

The questions that naturally arise are whether the European Semester is worth the effort, whether another policy coordination system should be designed, or even whether policy coordination should be scrapped. In our view the cross-country implications of national policies in the EU and the specific set-up of the euro area, with centralised monetary policy and banking oversight alongside decentralised fiscal and economic policies, make some form of dialogue between member states necessary. The European Semester has a legal basis and we do not believe that any other method of policy coordination is likely to work much better, because of the fundamental problem we have highlighted above. Therefore, efforts to revamp the European Semester are welcome, but expectations about possible achievements should be realistic.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.