Blog Post

Five Lessons on Greece

A reflection on the experience of Greece and other countries who have implemented rescue programs

The agreement reached at the Eurosummit in the early hours of on July 13[1] marks yet another dramatic turning point in the five-year history of attempts to avoid Greece’s sovereign default and its potential exit from the euro area. It is too early to say whether it will be successful or not. Many important details such as fiscal targets, other conditionalities, the scale of emergency financing, resolution of Greece’s large public debt and distressed banking sector will have to be negotiated in the coming weeks and months. On the other hand, the political commitment and administrative capacity of the current government of Greece to deliver on such an ambitious reform program remains in question.

Nevertheless, perhaps it is the right time to look back and reflect on the experience of Greece and other countries who have implemented rescue programs and reformed their economies in distress to draw lessons. These may help in future policy choices. Below I offer five but it is not a complete list.

Lesson 1: Fiscal Sustainability Constraints Hold

Similarly to microeconomic agents (enterprises, households), governments cannot endlessly spend more than they receive in the form of tax and other revenue. They can do so only temporarily as long as there are creditors ready to lend. If a government goes too far it risks sovereign insolvency. Once it becomes bankrupt, a government must start running a balanced primary budget even if it totally negates on its outstanding liabilities to creditors. The reason is simple: no fresh financing is available. In most cases, this requires drastic fiscal policy tightening (elimination of a primary deficit). This is an elementary piece of fiscal arithmetic frequently forgotten in the debate in the Greece situation.

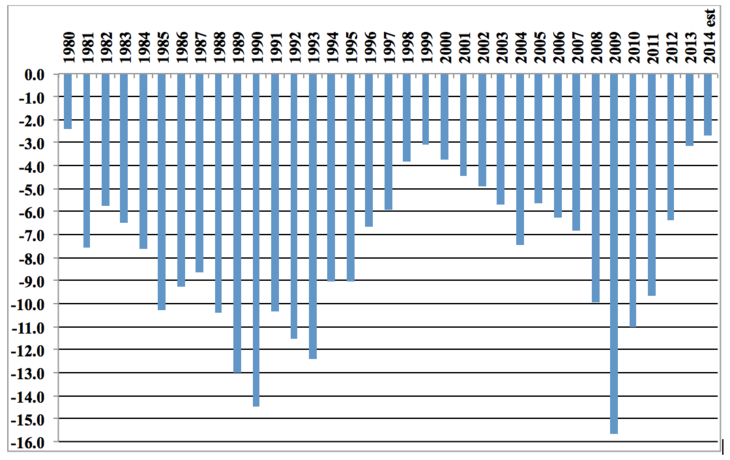

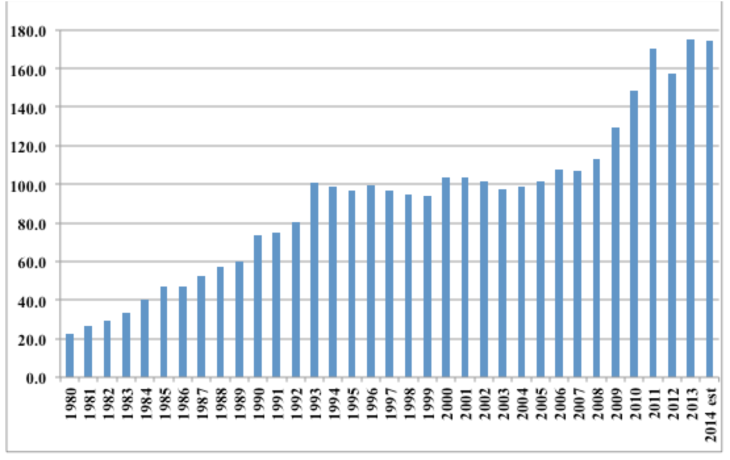

Greece overspent for decades, running fiscal deficits well in excess of the 3% Maastricht criterion (Figure 1) and building its public debt up to an evidently unsustainable level (Figure 2). The bust came in 2010 when private creditors refused further lending at reasonable price. They were replaced and partly bailed out by the official creditors (see Lesson 5) and Greece could continue public borrowing. In fact, the subsequent rescue programs monitored by the ‘Troika’ allowed Greece slowing the pace of its fiscal adjustment as compared with a scenario of no rescue program (as noted by Olivier Blanchard[2]) in exchange for promise of reforms, which have never been fully implemented (see Lesson 3).

In spite of its numerous weaknesses (see Lesson 3), Greece’s rescue programs started to bring positive results in 2014, including a primary fiscal surplus, some improvement in competitiveness[3] and the beginning of economic recovery. However, after negation of the ongoing rescue and reform program by the Syriza government (validated by the results of July’s referendum – see Lesson 4) the official creditors lost their appetite for further support – at least on the same conditions.

Figure 1: Greece: GG fiscal balance, % of GDP, 1980-2014

Source: IMF WEO, October 2014

Figure 2: Greece: GG gross public debt, in % of GDP, 1980-2014

Source: IMF WEO, October 2014

Because other euro area countries are not ready to offer Greece unconditional transfers the country faces two choices: either accept the creditors’ conditions and receive a third bailout program, or default, allowing the banking to sector collapse and probably leaving the Euro[4]. However, the second scenario will not make macroeconomic and fiscal choices easier. The Greek authorities will have to run at least a primary fiscal balance and tight monetary policy to avoid hyperinflation. The reforms required by the creditors will have to be carried out anyway.

Lesson 2: The role of trust

During the dramatic negotiation of 11-13 July 2015, many commentators pointed to the lack of trust between the government of Greece and its creditors – and rightly so. This trust has never been strong given numerous past episodes of statistical misreporting and the slow pace of Greek reforms (see Lesson 3). But it has definitely been devastated by the erratic behaviour of the Prime Minister Alexis Tsipras and the former Minister of Finance Yanis Varoufakis over the course of almost half a year of negotiations on extending the previous rescue program, including its sudden breaking off, calling a referendum and agitating for the “No” vote.

However, the trust has been lost not only in relations with official creditors. Business and market confidence has been also damaged by the Syriza government as evidenced by the returning recession in the first half of 2015, the decline in tax collection and massive capital flight. The government has become cut off from any form of market borrowing again, even short term. Breaking off negotiations with creditors and calling the referendum triggered a run on banks at the end of June which led to suspending most of their activities, limits on cash withdrawals and capital controls. Most importantly, the populist ploy with the referendum and then a total negation of its result has undermined trust between the Prime Minister and large parts of the Greek population, including his own political supporters (see Lesson 4).

When trust is devastated and a country is bankrupt the idea of continuing counter-cyclical fiscal fine-tuning to boost growth, as advocated by the anti-austerity zealots such as Paul Krugman[5] and Joseph Stiglitz[6], does not make much sense. In fact it looks like an evident misreading of Keynesian theory. In the case of Greece, slower fiscal adjustment means two things: (i) slower pace of important structural and institutional reforms (overhaul of VAT, pension reform, privatisation) which are important for growth; (ii) an even higher public debt burden, which undermines business and consumer confidence and, therefore, kills growth prospects.

Thus, rebuilding trust in all the above-mentioned dimensions is the absolute priority for Greece and a precondition to return to economic growth and financial stability. It requires among other things radical changes in the way in which economic policy has been conducted (see Lesson 3).

Lesson Three: Speed of Reforms and Their Ownership

A month ago, I wrote on the slow-reform trap in the context of Ukraine[7]. However, all arguments used then (changing expectations, producing visible reform results early enough, political economy) apply to Greece too. As documented by Anders Aslund[8], Latvia, which was also hit by a severe financial crisis in 2008-2009, managed to overcome its negative consequences and return to rapid growth in 2011 and to fiscal surplus in 2012. This was possible due to a frontloaded large-scale fiscal adjustment and a comprehensive package of structural and institutional reforms.

In fact, the election victory of Syriza in January 2015 was a product of slow reforms. Since 2010, the Greek people has had to absorb the pain associated with the crisis and reforms (slower reforms do not mean less pain) but without clearly visible gains. This made many of them receptive to populist arguments and promises.

A slow pace of reforms usually signals the limited political commitment of the government. In this context, Kenneth Rogoff[9] underlines importance of the so-called country ownership of a reform program. If such ownership is lacking, even the best-designed rescue program and its conditionality will not work. In case of Greece, ownership of reforms has been always problematic.

I am afraid this could also pose the biggest challenge for the new program. Even if Greek society is ready to accept some unpopular measures to stay in the euro area and regain access to its bank accounts, such support will not be automatically translated into a new parliamentary majority able to form effective pro-reform government. Greece may face months of political instability and uncertainty. On the other hand, the high-degree of intrusiveness of the new program (which can be seen as creditors’ insurance against a doubtful reform commitment from the Tsipras government) may easily produce a new wave of populist backlash once the danger of immediate Grexit disappears.

Lesson Four: Democracy Must Involve Responsibility

The referendum of 5 July 2015 raised huge excitement as a supposed evidence of Greece’s vibrant democracy and aspiration to regain a sovereignty compromised by the bailout programs. Joseph Stiglitz went even further in suggesting “Europe’s Attack on Greek Democracy” [10].

Indeed, a referendum can be one of the instruments of a direct democracy. However, in the discussed case it was heavily abused. First, it was organised in a rush and, most probably, breaching the constitution of Greece which (rightly) does not envisage possibility of referenda on financial matters. Second, the question asked was too long, unclear and not easy to understand for the general public. Third, the government information campaign was not fair, i.e., it did not present a real choice faced by the country. In fact, the Prime Minister offered society “you can have your cake and eat it too”. Fourth and most important, the day after the referendum the same Prime Minister negated its results and accepted (or even went further than) the deal which he recommended (successfully) to reject. Thus, the 5 July referendum did not serve to strengthen Greek democracy but, somewhat naively, to impose pressure on creditors. Obviously, populist games of this kind can only undermine democracy.

More generally, democracy must involve responsibility for the decision taken, including all hardships associated with wrong choices – in particular if they have been repeated several times as in the case of Greece. In this context, it is difficult to accept Barry Eichengreen’s view that “Greece deserves better. It deserves a program that respects its sovereignty and allows the government to establish its credibility over time” [11]. Who is going to pay for this better program?

Here we touch another important question: democratic mechanisms and decisions must respect limits of their jurisdiction. They cannot burden other countries with the consequences of their own choices. Governments of those other countries must follow preferences and limits on their actions imposed by their own electorates (see comment of Dani Rodrik[12]).

The Greek society and its political elites must accept the unpleasant fact that the range of available economic choices for a bankrupt country is more limited in comparison with a solvent one and think how to reform Greece’s political systems to avoid repeated incidences of economic mismanagement in the future.

Lesson Five: Rules Are Important

The first rescue program for Greece meant circumventing an important market discipline rule written into Article 125 of the Treaty on the Functioning of the European Union (TFEU). The so-called “no bailout” clause was replaced by the quite complicated mechanism of conditional bailout, i.e. financial assistance in exchange for fiscal adjustment and structural and institutional reforms. Article 123 of the TFEU, which prohibits European Central Bank (ECB) and national central banks to finance governments has been also compromised by a large ECB exposure to Greece sovereign bonds and the mechanism of Emergency Liquidity Assistance (ELA) which supports Greek banks against the guarantees of their insolvent government.

At the same time, as noted by my colleagues Ashoka Mody[13] and Guntram Wolff[14], the International Monetary Fund (IMF) breached two of its operational principles, i.e. lending only against the program, which offers a convincing solvency perspective (regaining market access) in its life horizon and so-called private sector involvement, i.e. participation of commercial creditors in debt restructuring. None of these conditions was met in May 2010 but some corrections (debt restructuring deal with private creditors) came in 2011-2012 with the second bailout program.

Whatever has been the reason to breach both EU and IMF rules (primarily, the fear of market contagion in a situation when most EU governments remained heavily over-indebted and large European banks are heavily exposed to the sovereign debt of peripheral euro area countries) now the official creditors must pay a heavy price for that.

First, there is a classical moral hazard problem, both for private creditors and sovereign borrowers. As demonstrated by the behaviour of Syriza government (and demand of populist parties in other European countries) this is not a hypothetical threat.

Second, as in the experience of many federal states (for example, Argentina, Brazil or Russia in the 1990s) lack of discipline on a sub-federal level may easily lead to a fiscal crisis on a federal level and destabilise a common currency. Fortunately, the EU/EMU did not get to this point yet.

Third, if the federal level lends to a distressed and undisciplined sub-federal entity it quickly becomes its financial and political hostage. This is indeed the most dramatic dilemma faced by the euro area countries and the ECB today: allow Greece to go bankrupt and accept loses on the outstanding claims on Greece, or continue lending and increase their exposures, even if chances of debt repayment remain highly problematic. The July 13 agreement can be seen as a dramatic attempt to keep Greece afloat but at least partly reinforce rules. It remains to be seen whether this attempt has any chance to succeed.

Finally, despite the declared solidarity with Greece (and other euro area countries in distress) the subsequent bailout programs did not increase the degree of political cohesion within the EU and EMU. On the contrary, it provoked a distributional conflict between creditor and debtor countries (especially in the case of Greece) and waves of nationalism and populism in various countries. Solidarity is perhaps a nice idea but not necessarily in the realm of inter-governmental fiscal relations.

[1] http://www.consilium.europa.eu/en/press/press-releases/2015/07/pdf/20150712-eurosummit-statement-greece/

[2] http://blog-imfdirect.imf.org/2015/07/09/greece-past-critiques-and-the-path-forward/

[3] /nc/blog/detail/article/1647-is-greece-destined-to-grow/

[4] See /nc/blog/detail/view/1662/

[5] http://krugman.blogs.nytimes.com/2015/07/15/an-unsustainable-position/?module=BlogPost-Title&version=Blog%20Main&contentCollection=Opinion&action=Click&pgtype=Blogs®ion=Body

[6] http://www.project-syndicate.org/commentary/greece-referendum-troika-eurozone-by-joseph-e–stiglitz-2015-06

[7] /nc/blog/detail/article/1649-the-slow-reform-trap/

[8] http://www.case-research.eu/sites/default/files/publications/S%26A477.pdf

[9] http://www.project-syndicate.org/commentary/why-the-greek-bailout-failed-by-kenneth-rogoff-2015-07

[10] http://www.project-syndicate.org/commentary/greece-referendum-troika-eurozone-by-joseph-e–stiglitz-2015-06

[11] http://www.project-syndicate.org/commentary/greece-debt-agreement-risks-by-barry-eichengreen-2015-07

[12] http://www.project-syndicate.org/commentary/greece-referendum-nationalism-democracy-by-dani-rodrik-2015-07

[13] /nc/blog/detail/article/1681-professor-blanchard-writes-a-greek-tragedy/

[14] /nc/blog/detail/article/1680-olivier-blanchard-fails-to-recognise-two-major-imf-mistakes-in-greece/

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.