Blog Post

Inflation Surprises

While it is still too early to tell if the ECB QE programme launched on March 9 will manage to bring back inflation towards the target in the medium term, a look at market- and survey-based inflation expectations data allows us to get a sense of how inflation expectations have been evolving in the last few months.

Euro area consumer price inflation, as measured by the HICP, continues to undershoot the ECB’s target of “close to, but below 2%”, currently at -0.1% in March. While it is still too early to tell if the ECB QE programme launched on March 9 will manage to bring back inflation towards the target in the medium term, a look at market- and survey-based inflation expectations data allows us to get a sense of how inflation expectations have been evolving in the last few months.

What the Market says

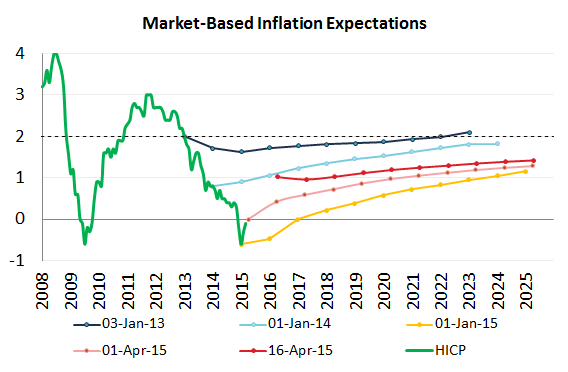

The chart below plots the HICP (in green), and market-based measures of average future inflation, based on zero-coupon swaps, which show the expectations over the periods from 1 to 10 years ahead.

The first observation is that market inflation expectations have been sliding continuously from 2012 to January 2015 (see the lines from blue to bright yellow), matching the sharp and steady collapse in headline HICP inflation that took place during that period, and prompting the ECB to act further and launch sovereign QE at its 22 January 2015 Governing Council meeting.

Source: Datastream, European Central Bank, Bruegel Calculations. Note: Market based inflation expectations refer to zero-coupon swaps over a time horizon of 1 to 10 years

However, since the beginning of February we can see some positive developments at the shorter horizons of 1 to about 5 years. This is shown by the upwards shifts in the dotted-lines, from lows of below zero at 1-year forward in January this year (light orange), up to nearly 1% as of last week (red). Even though inflation in the eurozone is still expected to miss its target in the next ten years (with expectations of inflation only averaging 1.4% from now to 2025), this is nevertheless a positive development and a welcome turnaround after the dis-anchoring of inflation expectations observed in the last couple of years.

What Forecasters say

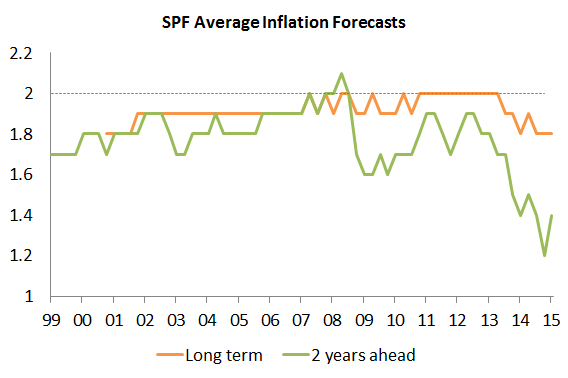

This turnaround is also visible in the ECB’s Survey of Professional Forecasters. Its latest edition published last week shows a slight rebound, with two-year ahead inflation average expectations rising from 1.2% to 1.4%, while long term expectations seem to have stabilised at 1.8%.

Source: ECB SPF (Survey of Professional forecasters); Note: “Long-term” refers to inflation expectations 5 year ahead.

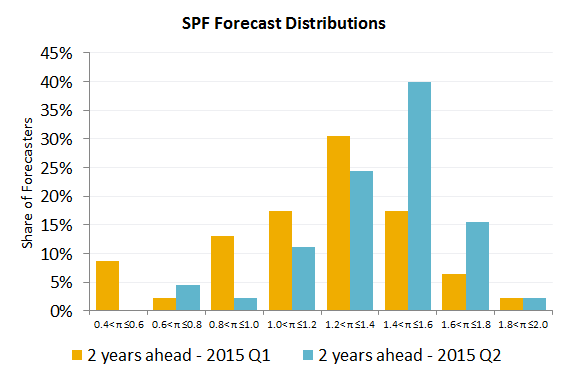

Another way to look at this survey is from the perspective of the distributions of forecasts. For the 2 year ahead forecasts, the share of higher forecasts has increased substantially in the new survey compared to the one published during the first quarter of 2015. There was also a noticeable narrowing of the variance of responses, suggesting a decrease of uncertainty concerning the inflation outlook for the next two years.

Source: ECB SPF and Bruegel calculations.

Why have inflation expectations increased lately?

It is difficult to disentangle the main reasons behind the recent increase in expectations, but 3 main explanations immediately come to mind: 1) the ECB QE programme, 2) the stabilisation of oil prices, 3) some positive data releases.

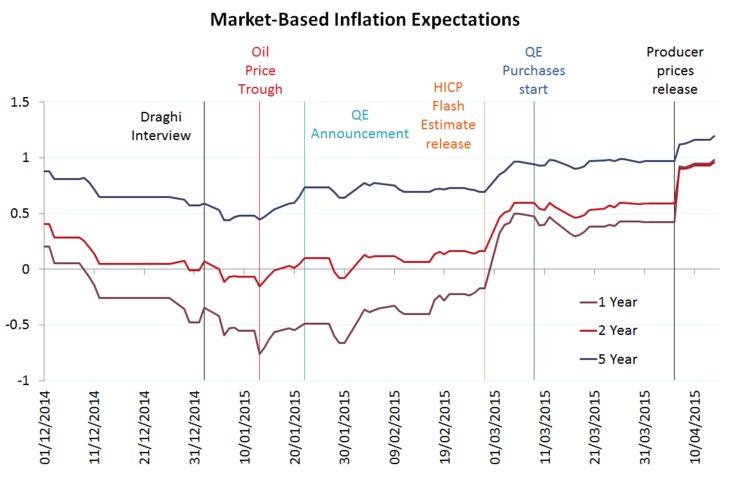

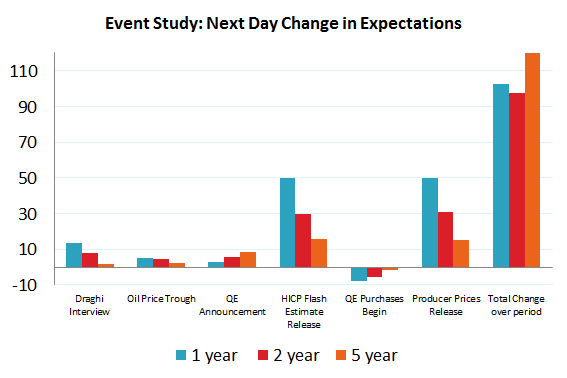

The charts below depicting the evolution of daily market inflation expectations can help us identify what could be driving the recent improvements.

Source: Datastream, Bruegel Calculations. Market based inflation expectations refer to zero-coupon swap rates over a 1 to 5 years period.

Source: Datastream, Bruegel Calculations. Market based inflation expectations refer to zero-coupon swap rates over a 1 to 5 years period.

The first possible event is an interview of Mario Draghi by the German newspaper Handelsblatt (2nd January, in which he suggested that the ECB was gearing up for an asset purchase programme) – this had the mild effects of moving expectations up by 13.4, 7.6 and 1.8 basis points.

A change in direction of developments in oil prices (Brent Crude reached its trough on 13th January) contributed 5.0, 4.5 and 2.4 bps respectively.

Thirdly, it’s interesting to note that market measures of inflation expectations haven’t moved much at the QE announcement date. The 1-, 2-, and 5-year swap rates increased by 2.6, 5.4 and 8.5 basis points respectively. Of course, markets had been anticipating QE for a few months and were probably already pricing in some effect on inflation of the QE programme, so the absence of a large step-shift on the day of the announcement is not totally surprising.

Leading on from this, the actual implementation of the QE program did not steer swap rates much (-7.9, -5.3, 1.6)

More significantly, the two main drivers behind the upticks in the market measures, especially at shorter horizons, seem in fact to have been the releases of two inflation measures:

On 2nd March the HICP flash estimate for February came in higher-than-expected. The day-to-day change in expectations were 49.6, 29.7 and 15.6 bps respectively, an order of magnitude larger than any of the previous events studied. This idea of a positive inflation surprise is backed up by the responses of the economists participating in the Bloomberg survey who were predicting an even lower level of inflation in February (-0.4%) than what was actually observed (-0.3%).

The second surprise came in the positive producer price inflation data published by Eurostat on 7th April – again day-to-day changes were much larger than the other events – 49.9, 30.9, 14.9 bps respectively.

Conclusion

While the ECB QE programme and the stabilisation of oil prices are certainly playing a role in shaping inflation expectations on the upside, we find that the developments between December 2014 and April 2015 in market- and survey-based measures of future inflation are still mainly concentrated in the short-term and appear to come essentially from positive surprises in inflation data releases. Unsurprisingly, the surprise in inflation led to a change in inflation expectations. Whether the surprises in inflation data were themselves driven by improvements related to QE, and in particular to the recent euro exchange rate decline, or by other factors (e.g. more downward price stickiness than anticipated), remains for future research.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.