Blog Post

Much pain for small gain: difficulty of cost adjustment in the euro area

IMF’s latest World Economic Outlook discussed reasons for relatively stable inflation following the Great Recession. It noted that large output gaps and high unemployment have resulted in surprisingly little disinflation in advanced countries. This was attributed to more firmly anchored long-term inflation expectations as well as the reluctance of workers to accept nominal wage cuts. The positive implication is that efforts to stimulate the economy should not result in rapidly rising inflation even if output gaps are overestimated provided that long-term expectations remain anchored. However, the finding also means that intra-euro area price adjustment is more challenging, which is the focus of this blog entry.

IMF’s latest World Economic Outlook discussed reasons for relatively stable inflation following the Great Recession. It noted that large output gaps and high unemployment have resulted in surprisingly little disinflation in advanced countries. This was attributed to more firmly anchored long-term inflation expectations as well as the reluctance of workers to accept nominal wage cuts. The positive implication is that efforts to stimulate the economy should not result in rapidly rising inflation even if output gaps are overestimated provided that long-term expectations remain anchored. However, the finding also means that intra-euro area price adjustment is more challenging, which is the focus of this blog entry.

Amid weak domestic demand, growth in Southern Europe is heavily reliant on increasing net exports to regain growth. We have already documented a significant improvement in the external balance of southern economies. This has been mostly export-driven in Ireland, Spain and Portugal while Greece has adjusted exclusively through import compression. Slower wage growth in the south than in Germany since the start of the crisis is part of the story but it has coincided with very high unemployment.

Can the moderation in wage growth in the south and the simultaneous pick-up in Germany be explained by the unemployment levels? Is the intra-euro cost adjustment working as expected through changes in unemployment levels? What does the Philips curve relation imply for adjustment?

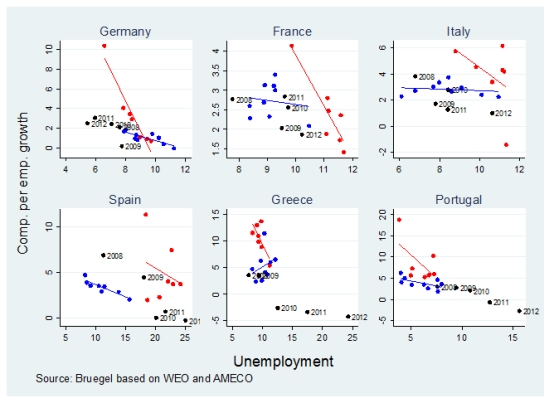

In Figure 1, we plot the Philips curve based on wage inflation for two periods: pre- and post-EMU. A number of findings stand out. First, the Phillips curve generally became flatter since 1999. Second, wage developments in the most recent period are relatively well explained by the estimated Phillips curve. In particular, German wage developments since 2008 are consistent with its Phillips curve for 1999–2007. Also the estimate of German wage inflation of 2.8 % this year (Lichtenberg 2013) is in line with the pre-crisis curve.

Figure 1: Phillips curves based on unemployment and growth in compensation per employee (1992–2012).

In Spain we can detect excessive wage increases in 2008 and 2009 when unemployment was already rising considerably. However, wage growth since 2010 has been consistent with the pre-2008 relationship between compensation and unemployment.

In Greece the Phillips curve for the period 1999–2007 is influenced by the very high (11.4 %) wage growth in 2002. Nevertheless, the very steep curve of the 1990s has been replaced by a more gently sloped relationship since the crisis. Since 2010 Greek unemployment has increased dramatically with three continuous years of nominal wage cuts.

Recent wage developments in France, Italy and Portugal are also broadly compatible with the pre-crisis Phillips curve with high Portuguese unemployment coinciding with two successive years of reductions in compensation.

The flat curve has important implications for adjustment in the EMU. If we use past wage inflation divergence as a simple measure of how much wages may have to correct, significant relative wage adjustments are still ahead. Table 1 represents the cumulated differences in hourly wage inflation relative to Germany pre- and post-crisis.

Table 1: Difference in cumulated hourly wage growth relative to Germany.

|

Period |

Spain |

France |

Greece |

Italy |

Portugal |

|

2000-2007 |

20.1 |

16.3 |

42.1 |

12.6 |

18.0 |

|

2007-2012 |

-2.5 |

0.2 |

-15.5 |

-2.3 |

-8.0 |

|

2000-2012 |

19.4 |

18.5 |

23.8 |

11.4 |

9.9 |

Note: As an example the 2000–2007 figure for Spain is calculated as the difference in cumulated wage growth in Spain in 2000–2007 (29.5 %) and Germany (9.4 %), i.e. 29.5 %-9.4 %=20.1 %.

Source: Bruegel based on ECB.

Wages grew considerable faster in all of the highlighted countries than in Germany pre-crisis. Although all except France have undercut German wage growth since 2007, German wage costs have still increased by considerable less than in other countries over the whole period of 2000–2012.

Greece and Portugal have roughly halved the pre-crisis excess wage growth relative to Germany since 2007. This has coincided with an increase in unemployment by 16 %-points in Greece and 7.7 %-points in Portugal, a tripling and doubling of the pre-crisis levels respectively. Therefore, only a very severe recession led to the price adjustment.

In turn, in Germany, unemployment had to fall to really low levels before wages started to pick up. The flat German Philips curve also means that it is unlikely that wages will increase very significantly in the future. This again renders adjustment of relative prices in the euro area more difficult.

The IMF concludes that a flatter Philips curve signifies that monetary policy has more leeway to operate. This is true for the euro area as a whole. However, it does not help with achieving relative wage adjustment. The flat Philips curve instead suggests that in order to avoid sustained and prolonged high unemployment rates, other instruments are needed to shift the curve. One option could be the more deliberate use of fiscal devaluation strategies.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.