Blog Post

The European Union remains a laggard on banking supervisory transparency

Financial supervisors must provide the public with more information about the European banking sector in order to ensure financial stability. The level of transparency in national supervision of banks has dropped since 2013.

Supervisory transparency, or the publication by prudential supervisors of data about the institutions they supervise, is an essential tool to ensure market discipline in the banking sector and thus supports the public-policy objective of financial stability, in complement to disclosures made by the banks themselves. In the European Union, we find that the already low level of supervisory transparency has generally not improved, and even deteriorated, in early 2016 compared to a previous survey made in 2013 (Gandrud and Hallerberg, 2014). Supervisory authorities, including the European Central Bank (ECB) in its new capacity as euro-area financial supervisor, should dramatically step up their efforts to provide the public with more information about Europe’s massive banking sector.

In the European Union, we find that the already low level of supervisory transparency has generally not improved, and even deteriorated.

In early 2014, two of us published the results of a 2013 survey of data disclosures by national bank supervisors in the European Union. At the time, we found that only 11 of the Union’s 28 member states made any such information easily available on the internet. This post presents an update of this research, and the conclusion is bleak. At the national level, the picture has actually worsened. Of the five member states whose transparency level changed since 2013, four have become less transparent. And the only improvement is minimal: in Ireland, data about banks are no longer classified as confidential, but remain publicly unavailable.

At the European level, the inception of banking union in the euro area is a major change of policy regime since the previous survey, but has not yet made enough of a difference in terms of supervisory transparency. ECB Banking Supervision has regularly updated its list of supervised entities, and occasionally released data from exercises such as the 2014 and 2015 Comprehensive Assessments, but does not regularly publish quantitative data about euro-area banks beyond a highly imprecise indication of balance sheet size.

The inception of banking union in the euro area has not yet made enough of a difference in terms of supervisory transparency.

Also at the European level but predating banking union, the European Banking Authority (EBA) has continued to make important improvements in the area of supervisory transparency. But its efforts are insufficiently institutionalised, and do not cover the full spectrum of banks in the European Union. The EBA published results of a transparency exercise in December 2013, EU-wide stress tests in October 2014, and another transparency exercise in November 2015. These covered respectively only 64, 123, and 105 banks (of which one from Norway, the rest being all headquartered in the EU), so that the vast majority of Europe’s more than 3,500 banks, representing perhaps a quarter of total assets, are left out.

Supervisory transparency matters

There are legitimate questions about the extent to which supervisors should release the information that they collect about individual banks. There are concerns that too much transparency may reveal trade secrets, or that markets may punish banks that turn out to have weaker books than expected so much that bank failures become more likely. This may increase financial instability.

Supervisory transparency for individual banks should lead to more financial stability, not less.

Yet, even with these concerns in mind, there are compelling reasons why supervisory transparency for individual banks should lead to more financial stability, not less. Bankers will want to prevent adverse market reactions if they know that more data about them will be made public. Better transparency may facilitate contestability and mergers, especially cross-border mergers where information asymmetries are high. Data transparency allows parliaments and the public to better judge supervisors’ performance. This means that supervisors expect more scrutiny and so should act more responsibly. These benefits of transparency are well established in the relevant literature. For example, Nier (2005) finds that more transparent banks are less likely to experience a crisis, while Tadesse (2006) reports that countries with more extensive bank disclosure requirements were less likely to experience a systemic banking crisis.

Member state-level transparency in 2016

Back in 2013, member state supervisors tended to be opaque in regard to releasing bank-level supervisory data. Only 11 of 28 EU member states, and only 5 of 19 banking union countries, had individual bank data available in the original survey. These data were generally fairly simple balance sheet information, such as total assets and capital. Even in Spain, the country with the most comprehensive data, the level of detail was low. It did not include information on non-performing loans, a crucial metric for determining a bank’s health.

There have been almost no positive changes, and several moves backward, since 2013.

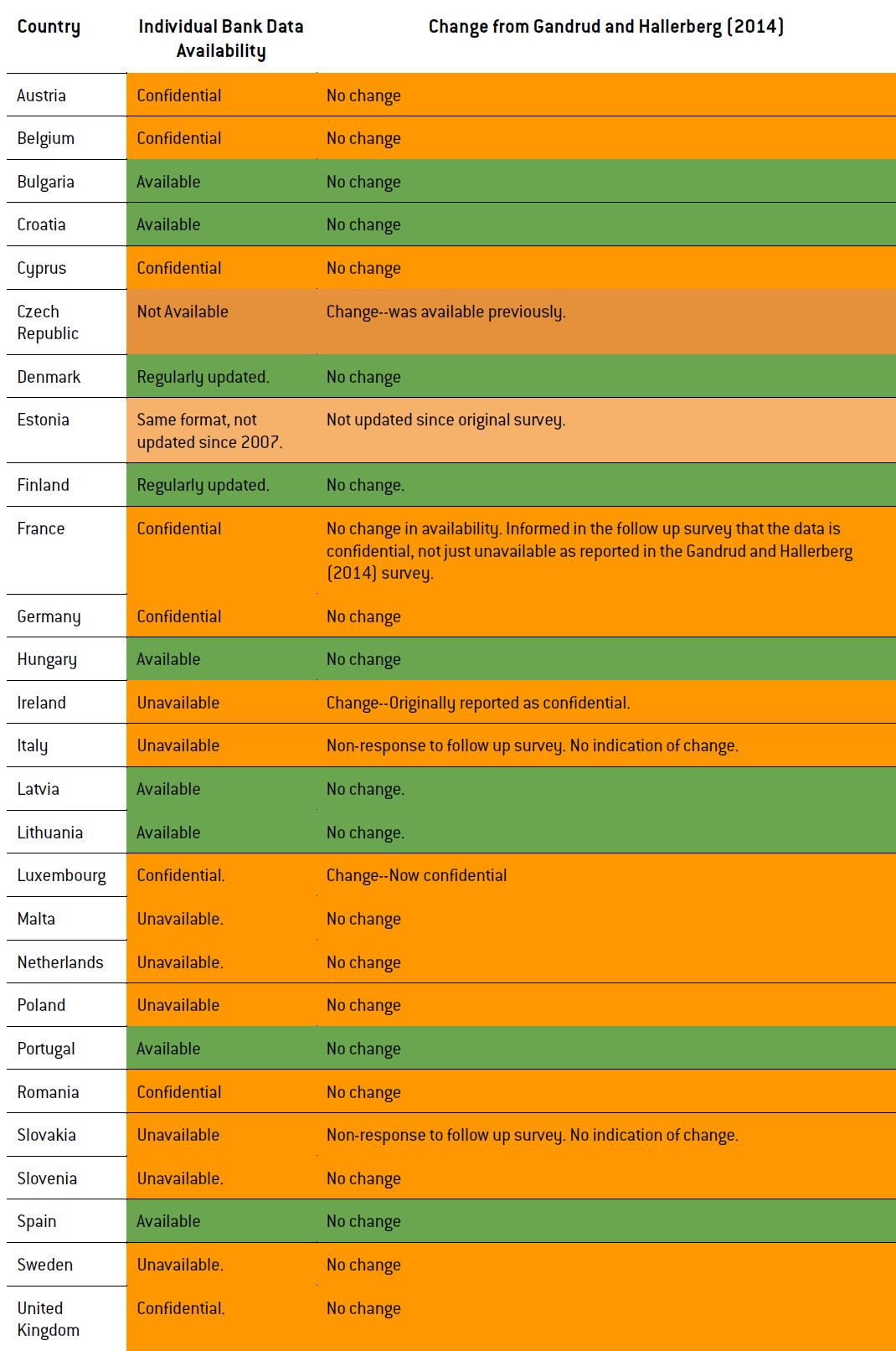

There have been almost no positive changes, and several moves backward, since then. Now only nine of the 28 EU member states, and four of the 19 banking union countries, make any individual bank data easily available online. Table 1 below highlights the changes. Table 2, at the end of this post, presents the full results of the updated survey.

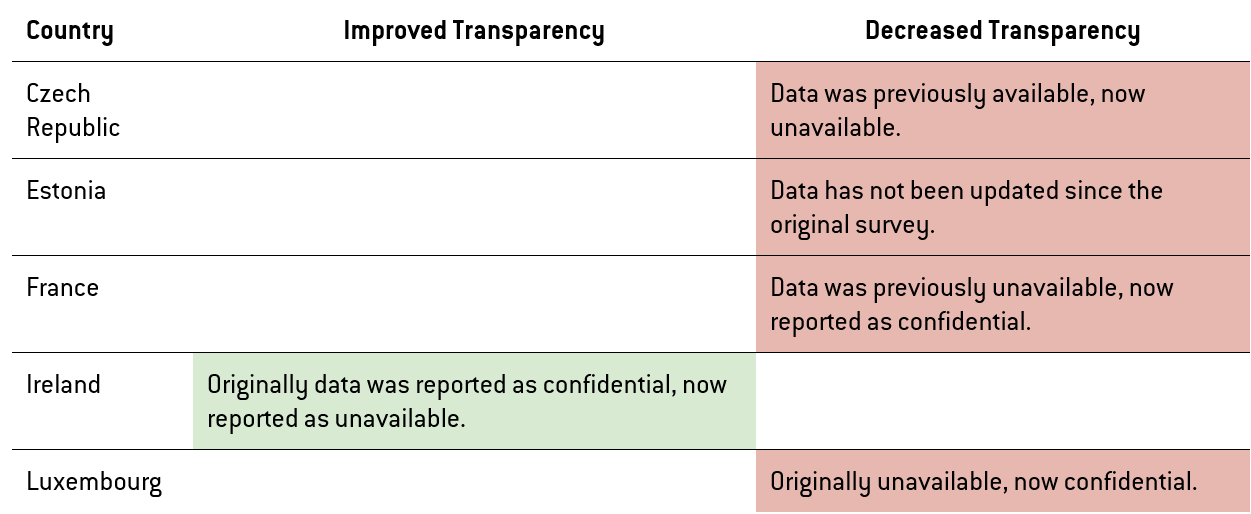

Table 1: Changes to Supervisory Transparency Survey, from Gandrud and Hallerberg (2014)

In four of the five countries where we found any changes to data transparency, the situation worsened. In France and Luxembourg, we found the data reported not only as unavailable, but now also confidential. This classification could make it even harder for the public and potentially other supervisors to access bank data. In Estonia, the data found in the original survey are still available, but have not been updated, suggesting that basic transparency measures were not institutionalised. The Czech Republic has had the largest shift towards opacity: data that were once available are now no longer so. The only limited improvement we found is in Ireland, where the data are no longer classified as confidential, but are still unavailable.

EU-level transparency in 2016

Financial supervisory data transparency at the EU level has moved in a more positive direction, but does not offset the shortcomings at the national level. EU institutions have conducted ad hoc transparency exercises and bank balance sheet reviews, and published many of the results. However, there is still considerable room for improvement as transparency measures have not been institutionalised, and so could be easily discontinued, and cover only a subset of Europe’s banks.

Transparency measures have not been institutionalised, and so could be easily discontinued, and cover only a subset of Europe’s banks.

ECB Banking Supervision provides data on individual banks through its Comprehensive Assessment process. There was a Comprehensive Assessment of 130 banks in 2014, one of 9 additional banks in 2015, and another review is planned for 2016. The ECB also publishes bi-annual consolidated banking data for all EU banks broken down by country, domestic vs. foreign ownership, and bank size, but this information is not available at the bank level, and only presented as national aggregates.

Another source of information is the European Banking Authority (EBA), which covers all 28 member states. As noted in Gandrud and Hallerberg (2014), the EBA was active in creating EU-wide guidelines for regulatory disclosure and conducted a Transparency Exercise in 2013 that resulted in data being publicly released. At the time, there was no indication that this would be a recurring endeavour. Nonetheless, the EBA conducted a follow up exercise in 2015, which included 105 banks instead of only 64 in 2013. This exercise is valuable but should be further institutionalised, and its frequency should increase so that at least some of the data would be released annually or even quarterly.

Conclusion

Despite some positive, though insufficiently institutionalised, moves at the EU level, the trend in member states is towards less supervisory transparency. This is worrying, because the further successful integration of the EU financial sector requires financial market participants and the public to be able to access information on banks’ activities and health across borders. Some other jurisdictions provide much more detailed, regular and frequent information. In the United States, roughly 8,200 banks are required to make quarterly “call reports” that have data on the respective bank’s earnings, balance sheet, asset quality, liquidity and capital. A federal agency, the Federal Financial Institutions Examinations Council (FFIEC), makes this information available online, generally the day after it receives it. Evidently, technical reasons are not enough to justify the current lack of supervisory transparency in the European Union.

Table 2: Full Update of EU Member State Financial Supervisory Data Transparency Survey from Gandrud and Hallerberg (2014)

References

Gandrud, Christopher, and Mark Hallerberg (2014), “Supervisory Transparency in the European Banking Union”, Bruegel Policy Contribution 2014/01

Nier, Erlend (2005) ‘Bank Stability and Transparency’. Journal of Financial Stability, Vol. 1, No. 3, pp. 342–54.

Tadesse, Solomon (2006) ‘The Economic Value of Regulated Disclosure: Evidence from the Banking Sector’. Journal of Accounting and Public Policy, Vol. 25, pp. 32–70.

The authors are grateful to Marina Pavlova for excellent research assistance.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.