Blog Post

LTRO, interbank stress and banks’ stock prices: a conundrum?

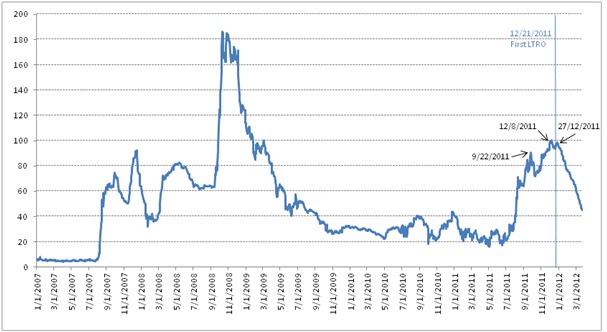

Stress in the interbank market increased steeply after July 2011. The figure below shows the pattern of the Euribor-Eonia Swap spread, an indicator of the interbank market stress, from 2007 up to now. A first peak was recorded at the end of September 2011 and then the stress peaked in December 2011. Since the end of December, the spread receded considerably and this can be linked to the long-term refinancing operations (LTRO) of the ECB which has provided abundant liquidity to banks to ensure their financing.

Stress in the interbank market increased steeply after July 2011. The figure below shows the pattern of the Euribor-Eonia Swap spread, an indicator of the interbank market stress, from 2007 up to now. A first peak was recorded at the end of September 2011 and then the stress peaked in December 2011. Since the end of December, the spread receded considerably and this can be linked to the long-term refinancing operations (LTRO) of the ECB which has provided abundant liquidity to banks to ensure their financing.

Source : Bruegel calculations with data from Datastream.

The ECB has clearly stepped into a non-functioning interbank market but has it bailed-out banks? One way of assessing a bail-out of a bank is to look at the stock market value of the bank. A bail-out typically means that the stock price of the bank increases. In principle, the low-cost 3-year loans offered by the ECB should be seen by market operators as helpful for the soundness of the banking system and thereby help banks stock. However, the LTROs could have a negative impact on the banks’ performance if the banks’ participation in the LTRO would signal their shortage of liquidity to financial markets.

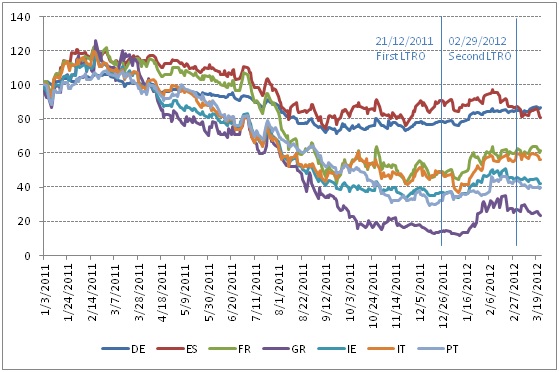

We look at the normalized average bank stock market index consisting of the banks located in a given country since January 2011. Our sample consists of those banks stress-tested in the recent stress test of the EBA and we describe the details of our methodology in Angeloni and Wolff (2012). Banks’ market value developed differently in the five countries, with stock values of Greek banks declined by the greatest amount. However, we cannot see a clear pattern of the effects of the ECB’s LTRO. Stocks continue to move sideways since October and seem unaffected by the ECB’s operations.

Source: Bruegel calculations with data from Datastream.

Note: Daily data, normalised.

This result suggests that the ECB helped ensure the funding of banks but did not bail-out banks. As would be expected with refinancing operations, the ECB will only step into a loss after the value of the collateral and the value of equity is exhausted. Seen from this angle, the ECB helped the financial system’s stability but not the shareholders of banks. More research on assessing the detailed impact of the LTRO would be great to have.

Republishing and referencing

Bruegel considers itself a public good and takes no institutional standpoint. Anyone is free to republish and/or quote this post without prior consent. Please provide a full reference, clearly stating Bruegel and the relevant author as the source, and include a prominent hyperlink to the original post.